Summary

Co-Diagnostics is well positioned to benefit from incremental fundamental momentum seen at the back end of 2020.

The company’s Covid-19 tests are differentiated by distinguishing between common cold and SARS-CoV-2 with an easy to use platform.

Given the epidemiology of the common cold and influenza A+B, testing volumes will likely remain high as an exclusion barrier to Covid-19 spread.

We feel the market is unfairly discounting shares and believe shares are worth ~13-$20 in the base and upside case.

Here, we provide investors with additional factors for consideration in the investment debate.

Investment Summary

Co-Diagnostics (CODX) is well positioned to benefit from ongoing Covid-19 tailwinds, that look set to remain in situ over the coming 12-24 months at least. We would point to investors that a full roll out of the vaccine will likely be realised into 2021/2022, therefore, Covid-testing is set to remain a focus area for clinical diagnostics players like CODX over this time period. Additionally, the company has other vertical offerings on the testing menu, which enable a wider commercial reach, and the opportunity to create a diagnostic breakthrough in complex disease segments.

Exhibit 1: Single-year price performance

Data Source: Author’s Bloomberg Terminal

Consequently, we are bullish on the long-term outlook of CODX shares and believe long-term upside is visible. As such, the market may be under-reflecting pipeline potential and the commercial opportunity in CODX’s clinical diagnostics business at the current prices. We feel that shares may converge to the upside as additional inflection points begin to roll out over the coming 12-24 months. Here, we provide key factors for consideration that help bolster the investment case for CODX, that the market and certainly the sell side are overlooking at this point in time.

First Factor of Consideration: Covid-19 Testing Is Here To Stay, For The Medium-Term At Minimum

It is likely that physicians and specific arenas like places of employment and logistics networks will continue to order Covid-19 testing regimes for the foreseeable future. Airlines, for example, will require a negative Covid-19 test at minimum for permission to fly over the next 12-24 months, probably much further into the future in all reality. This notion extends to patients to who will be inoculated against the virus, however, may be exhibiting Covid-19 symptoms, in the interest of over-caution and prevention of spread. CODX is well positioned to benefit from the same, especially given their focus on producing high performance testing regimens that, work on most PCR devices, and a suite of other extraction methodologies. CODX has strategic collaborations with laboratories that can offer efficient testing solutions, including tests that can be administered from home, at the workplace, or even in the school environment. Based on this data, these tests can be basically administered anywhere, including for defence force personnel. Such offerings align with the current narrative in reducing face-to-face consultation times, in addition to reducing the overall contact exposure risks that are associated with Covid-19. These novel testing solutions also enable access to a wider TAM, being that no singular testing site is required for patients/individuals to attend, in order to complete their test. Thus, CODX reaches more people at any one time with this route.

The company possesses a solid Covid-19 testing menu, that extends to include a multiple gene assay to be supplied to international clients, and an ABC assay that can easily distinguish between influenza and Covid-19 in patients exhibiting common symptoms that overlap between the 2 conditions. One advantage that CODX has here, is the easily interpreted test results, which will be discussed a little later. Additional items in the testing regime also include an extraction free reverse transcription PCR, that is obtained directly from saliva, which, if successfully commercialised, will drastically reduce costs associated with testing and increase testing volumes on a similar scale. The fact CODX offers a test that can distinguish between influenza, flu and Covid-19 is a superior offering, that insulates the portfolio and differentiates away from just a Covid-19 pure play alone. This route widens the entire TAM to include all cold and flu patients, who, as a necessity, will require confirmation or negation against Covid-19 in the first instance.

To illustrate, cold and flu estimates in the US are anticipated for ~100 million individual cases, and some experts anticipate a collective of over 1 billion cases of the common cold per year in the years following. Epidemiological data seems to illustrate a high prevalence of the cold and flu in children, with a prevalence of 6-10 cases of the common cold each year in this sub-group. Considering these immense numbers, that must be distinguished from Covid-19, CODX has a wide market opportunity and equally as wide TAM as a key driver to top-line growth via testing volumes. Put simply, CODX’s testing assay has the potential to test as many individuals as possible presenting with flu-like symptoms, to distinguish between Covid-19 and simple cases of the cold. We firmly believe that this will be a legislative requirement over the coming 2 years at least, with further time-frames not an unreasonable expectation, based on a prevention type mindset in society. Additionally, by offering an ABC reverse transcriptase PCR test, the company immediately slots into the upper respiratory diagnostics segment, which has global market penetration potential for CODX. Plus, by offering this type of testing regime, all patients experiencing cold and flu like symptoms will be easily distinguished into the flu sub-group or the Covid-19 sub-group, adding weight the validity of CODX’s product offering.

In addition, given high-risk populations such as infants and elderly populations, the ABC testing assay can detect for the actual causative pathogens in flu and Covid-19, which sits above the current standard of testing regimen in antigen tests. What’s more, is that some experts have indicated that antigen testing is unsuccessful and dangerous for asymptomatic screening, presenting unnecessary risk-on situations for those showing no symptoms, as a screening protocol. Therefore, antigen testing will unlikely be accepted in screening protocols for asymptomatic patients, by our view. In fact, antigen tests have questionable efficacy and accuracy anyway, especially when compared to a reverse transcriptase PCR test. As per the centre for disease control, sensitivity in rapid influenza testing has a range of 50-70%, but a wider bound has been purported that reaches 10%-70% from some sources, particularly when compared to PCR. Remember, antigen tests don’t actually turn the speaker volume up on protein signalling, meaning the sensitivity can (and does) remain lower in viral scenarios. Much of the speaker volume as it were in protein signalling gets dampened when solutions are developed using liquids that enable permeability of the active material over test scripts. This means that a high number of individuals may receive false-positives or false-negatives in testing outcomes, but the challenge is compounded by the latter – the antigen test can’t really provide a true negative result.

Consequently, CODX has made significant movement on their Covid-19 testing regimes, especially by using non extracted saliva samples. This has been achieved through robust data that shows the CoPrimer technology can successfully identify the SARS-CoV-2 viral strain in human saliva samples, that do not require RNA extraction of the sample. This is a significant advancement in our view, that points to the accuracy and the mitigation of false outcomes in testing results. Moreover, the marginal cost benefits and time savings enable a faster distribution and turnover of test assignments, with a lower refractory period in test to result. As such, CODX, through distributors, has now commercialised the PCR test for Covid-19 direct to consumers, directly into the locations mentioned above – schools, workplaces, logistics etc. In the majority of cases, patients receive their results within/up to 24 hours following, and can be delivered electronically, aligning with the current integration of technology in sharing testing outcomes.

Second Factor: Recent Regulatory Tailwinds As Catalysts For Long-Term Price Change

The company also received regulatory authorisation for the Logix Smart ABC regime, which is used in influenza A & B and Covid-19 clarification, back in November 2020. On this note, the company also received approval for the Logix Smart Covid-19 multiplex test to be sold in IVD form to detect SARS-CoV-2 in markets that accept CE-mark approval. This means that the CoPrimer technology receives an additional layer of credibility and adoption to enhance the commercial opportunity, further cementing CODX as an upper respiratory diagnostics player. We believe that adoption in European markets will be especially fruitful for the company, given the situation over there at this point in time as it relates to the pandemic.

Adding additional weight to the CoPrimer platform is the clearance to manufacture and sell the Covid-19 multiplex tests as IVD in India, meaning that the TAM for CoPrimer and CODX’s testing platform has widened significantly on this approval. We believe that CODX will successfully drive the testing menu into physician accounts throughout India, giving enormous profit potential on the back of the same. The announcement comes back in late November and is through the joint venture with CoSara Diagnostics. Such a move in targeting penetration of India is strategic on behalf of CODX, given the WHO has recommended India as a jurisdiction where tests with multiple genes have significant influence on the legislature pertaining to health policy.

Ex-Covid testing, the company also recognises additional regulatory tailwinds via other approvals for separate molecular tests. These include for tuberculosis, malaria, hepatitis-C and B, HPV, plus a trilex test that is indicated for use in Dengue fever and the Zika virus. The company will continue to roll these out and increase capacity and availability to key end-markets in over 50 countries. Expanding on this approach, the company is also marketing additional mosquito vector control labels throughout the US, primarily targeting eastern and western equine encephalitis, Saint Louis encephalitic, and West Nile virus. As such, the comprehensive selection of testing items on the menu in such a wide geographical footprint represents significant asset value to the company and has the potential to drive long-tailed asset returns whilst unlocking shareholder value. It also serves as a solid foundation to continuously expand the testing reach to adjacent markets. We’ve seen evidence of this already through the agricultural vertical segment of the testing menu, which has strategic alignment with Bayer Corporation. This particular collaboration aims to present a proof of concept for CODX’s NGS library prep technology, for which we can expect additional readouts this year.

Third Factor: Fundamental Momentum Especially Through Incremental Top-Line Growth Patterns

From the exit of the 3rd quarter, total revenues posted reached ~$22 million, which was driven by solid sales but mainly from operating leverage received through strategic collaborations, where partners do the heavy lifting in commercialisation. This way, the company retains the EBIT margin whilst removing the execution risk, whilst CODX’s collaborator is shielded against the pipeline risk. Gross margins came in strong at 73% for the quarter, up from ~50% YoY, whilst the bottom line was helped by capitalisation of operating losses recognised in previous periods. The company also had ~$27 million in cash on the balance sheet, which looks healthy based on cash growth and the value creation for shareholders, growing the equity position by over $50 million in a single year. For the 9 months ending September, the company had generated ~$8 million in cash from operations, which speaks to the company’s revenue recognition via strategic collaborations, considering the large disconnect in profit versus cash flow.

In Q4, the company’s pre-announcement has signified the strongest quarter on record, where management expect a sequential growth pattern of ~20-25%, which calls for ~$27 million at the top by the end of Q4 2020. This would come in above the Street’s estimates, and is backed primarily by a resurgence in Covid-19 cases, and the facts raised earlier on testing volumes remaining a necessity for the foreseeable future. We are backing the company to produce ~$72 million for FY2020, but see a range of ~$75 million in the upside scenario, and our modelling calls for almost $200 million at the top by 2025 in the base case. On these points, the company has realised significant upside in key performance measures from the mid-point of 2020, which we highlight as the key performance zones in CODX’s growth story. Much of the differentiating factors for CODX’s testing regimes have been adopted and recognised by the market throughout this period, and the pull through from the back end of 2020 is now apparent in the Q4 pre-announcement. CODX has managed to drive ROIC to above 87% for Q3, which will likely continue on the rise for the coming periods at the current run rate. We’ve also seen wide expansions in revenue volumes, operating performance via NOPAT and free cash conversion, which were recorded at ~$25 million and $8.5 million for the quarter, respectively. This key performance zone at the back end of 2020 serves as a solid indicator for 2021 outcomes, backed by the market’s adoption of CODX’s differentiated testing platform, compounded by the requirements of individuals to distinguish been cold symptoms and Covid-19. Therefore, we believe the market is currently overlooking this aspect and is discounting the importance of Covid-testing in the face of the vaccine, which has yet to be rolled out to the masses. Much more so, is the fact that the vaccine will unlikely be rolled out to the wider population until the next 12-24 months. Thus, the sell side and the wider market are unfairly discounting CODX shares on this basis, by our view.

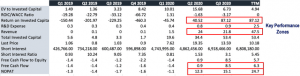

Exhibit 2. Key performance measures Q1 2019 – Q3 2020

Data Source: Author’s Calculations

Fourth Factor: Valuation

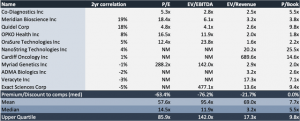

Share are trading at ~3x Q3 EBITDA and just over 2.5x sales. Furthermore, trading at 5.5x book value sits in line with the peer median, thus representing significant value creation for shareholders whilst at a respectable value. Shares are trading at ~61x FCF however, which sits at a premium. Although, on a EV/Gross profit basis, shares are only trading at ~8x Q3 gross profit. We are accustomed to using gross profit in analysis as this represents a cleaner measurement. Thus, at 8x gross profit, and in addition to other multiples, shares are trading at a significant discount to the peer group, which adds weight to the investment case. We would point investors to the fact that CODX is also trading below the 2017 market cap but has a significantly wider product offering than that time, and that shares are trading well below historical averages on a multiples basis, despite the recent fundamental momentum. We reiterate that the market is unfairly discounting CODX shares therefore, and the sell side is failing to pick up on this valuation disconnect, with only JP Morgan weighing in on the conversation. Even still, analysts there are missing the scope of valuation disconnect, and are still downplaying the fact of organic growth in testing volumes, instead touting typical sell side terminology like “better than expected Covid-19 molecular testing volumes” as the main driver for growth in CODX’s story for 2021. We believe this is far from the truth, and that we can expect organic growth in the myriad of test items in the company’s arsenal.

Exhibit 3. Multiples Comps Analysis

Data Source: Author’s Calculations

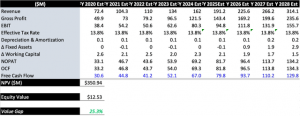

Discounting the asset potential in all segments, we believe shares are worth ~$12.50 today, representing ~20% upside on today’s trading (subject to change with publication times) in the base case. Should the company come in with exceptional testing volumes and early market uptake in adjacent markets like malaria and hepatitis for instance, then we see an upside case of ~$20, using a DCF model that builds in a hurdle of ~12%. This represents the opportunity cost of holding a 10-year treasury and the expected return of the S&P 500 over the same horizon. Constructing the discount rate in this fashion accurately represents the risks in forgoing more risk-off securities, without detracting from the upside potential, and also serves as a single rate for easy comparison between names. As such, given the upside potential in each calculation, both scenarios easily beat the hurdle and signify a risk/reward asymmetry that is skewed to the upside in terms of valuation.

Exhibit 4. DCF modelling, base case, 12% discount rate

Data Source: Author’s Calculations

Blending the DCF with a forward multiple of 8x our 2020 gross profit estimates with a 50% weighting schedule, then we see a price target of ~$13.30 over the coming periods, which we feel the company will walk towards near the end of Q4 2020 around earnings. It is important to include gross profit multiples in our forecasts for CODX’s valuation, as we feel that the profit trajectory will sustain into 2021, serving as a powerful forecasting tool. Shares are currently in the buy zone, and are worth close attention on entry at these valuations, especially given the unfair punishment received this year on the back of market perception. Therefore, we feel that the market is under-reflecting the asset potential for CODX, and that shares have the potential to converge to the upside, towards the valuations listed above.

Fifth Factor: The Charts- A Contrarian Viewpoint

On the charts, shares have faced downward pressures from the top since the selloff back in July/August. Since, shares have walked downward, and price dispersion has trended sideways, snaking around the mean return level, until the recent downtick in December. The mouth of the descending triangle is continuing to narrow, meaning downward pressure remains, and that shares are likely to make their next moves by mid-January, in the absence of any meaningful catalysts either way. We believe that earnings will be a significant up-step for CODX, especially given the sequential growth pattern in revenues across Q4, and underlying growth in testing volumes that we can expect for the span of 2021. Additionally, the levels seen back in July/August were largely on the back of hype, and weren’t sustainable without the fundamental backing to bolster the case. There was too much room for standard error, which came in the form of pricing risk and over-speculation. As such, shares are returning to a more consolidated level, where we feel may being the climb northwards, towards the valuation listed above.

Exhibit 5. Downward pressure on shares

Data Source: Author’s Bloomberg Terminal

Additionally, shares lie in healthy RSI ranges, whilst on balance volume has remained consistently high since the March 2020 selloff. Momentum has remained flat, in line with pricing distribution, however has not completely fallen off either. We believe that market bulls are simply overlooking CODX in search of other opportunities, and the lack of analyst coverage on the name is leaving an underexploited opportunity, that presents as a growth proposition at a reasonable valuation. Given this sentiment, in addition to the on balance volume and upcoming inflection points, we believe shares have the propensity to break the upper resistance bar at the ~$12-$15 level, bouncing away from support, which has held firm at ~$10 since August/October. As such, we feel that investors will benefit from additional upside, and advocate for entry at the current pricing levels. Should shares begin the walk northward, then we would encourage investors to trim and reallocate along the way, buying on each foreseeable bout of weakness, at the turnaround point from the movement to the downside in volatility.

Exhibit 6. Factor exposures of CODX shares

Data Source: Author’s Bloomberg Terminal

In Short + Risks

There are downside risks to our valuation narrative and CODX’s growth story over the coming periods. Whilst we firmly believe that Covid-19 testing names will show strengths across this year at a minimum, there is a chance that the market will shy away from testing and opt to go on about lives without having regular testing protocols in place. Much of the policy on testing comes from an institutional base, that is, factors like work/employment, schools, logistics, and travel, for instance. Thus, we would expect to see some headwinds to the growth story here should any one or all of these places forgo testing policy. Additionally, there is the market risk that pertains to CODX shares, in that the market may continue to favour other names over the company, and reward shares that present with additional offerings outside of clinical diagnostics. Furthermore, there is repeated language on the sector and factor rotation out of growth type names into more value orientated propositions, that may impact investor attraction to CODX in the first place. Mitigating these factors is the fundamental picture here, alongside the ongoing requirements to distinguish between cold/flu and Covid-19.

In short, CODX presents as a growth proposition that has realised fundamental momentum during the back end of 2020, that looks set to carry over into 2021 and beyond. Given the differentiated testing platform that is offered in Covid-19 multiplex tests, in addition to the wide offerings in things like malaria, hepatitis and others, CODX is well positioned to continue along the current trajectory whilst remaining insulated from peers. There is little doubt in our minds that Covid testing will remain in situ for the foreseeable future, especially as the vaccine still has a was to go before being successfully rolled out to the masses. Adding weight here is the fact that negative Covid-19 testing will likely be a requirement for many scenarios, thereby adding weight to CODX’s fundamental picture. Ex-Covid, then the company is also well positioned for upside, especially given the exposure to over 50 different geographies in the adjacent markets mentioned. As such, we feel shares are worth ~$13-$20 in the base and upside case right now, and believe that the charts will begin to reflect a more bullish narrative on Q4 2020 earnings, and into 2021 as more of the growth story unfolds here. We look forward to providing additional coverage.